In my last post I discussed the difference between an insight and an observation, how each required different work, and led to different results. Now I’ll use my journey as a mobile phone consumer over the last several years as an example.

Way back in the early 2000’s, I had a job that involved a lot of global travel. As a consultant, I needed to be able to make phone calls from anywhere, but at the time I had an old Sprint PCS phone plan, and an old flip phone. I don’t even remember the brand, what it could do, or why I owned it. (That fact is important.)

I quickly needed to learn about the best phone plan for the type of travel I was doing, and I needed a phone that could work across multiple frequency bands. As a self-proclaimed technology avoider, this was not an easy task.

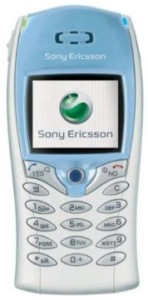

Why? The cell phone industry was (and still tends to be) geared toward speaking to consumers as if they care about the phones and technologies. I didn’t ( and still don’t) care about either. However, I became the office expert on which frequency bands were used in different global markets, which phones supported which frequencies, and which service contracts gave the biggest bang for the buck to ensure global service. As a result, I ended up with an AT&T plan that had excellent features for global travel, and a Sony Ericsson quad-band phone that took me everywhere except for places that used old CDMA technology.

Remember that I was (and still am) a self-proclaimed technology avoider; a pretty solid Late Majority or Laggard in the category. However, at that time I was also a Lead User – as I had extreme needs that were beyond the needs of the average consumer. A Lead User and an Early Adopter are not the same. An Early Adopter likes to try new things because they care about the category itself. For example, a technophile would have been more likely to be an Early Adopter of new technology.

Remember: Even a Laggard can be a Lead User if they have an extreme need. This does not make them an Early Adopter.

However, because of my purchasing patterns, the cell phone companies assumed that I was a technophile Early Adopter. I repeatedly fielded marketing calls from cell phone companies to receive a free “upgraded” phone if I switched my phone service. Here’s how they typically went:

“Hello, Ms. Di Resta. We’d like to offer you an upgraded phone…blah, blah, blah…”

“Oh, what’s upgraded about it?”

“Well, we see that you have the Sony Ericsson phone, and people who buy this phone typically like the latest features. This new phone has a cool new camera, and our plan has more text messages.”

“How many frequency bands does it have?”

“Three.”

“Which bands are they?”

(At which point they would usually name a popular US frequency, and two other obscure frequency bands.)

“Do you see from my usage that I frequently travel globally?”

“Oh, yes.”

“And from your description, this ‘upgraded’ phone would not actually accommodate my needs. Even with all these texts and a camera – as wonderful as they sound – it would actually be a ‘downgrade’ based on my current usage, correct?”

“Well, yes.”

“Thank you, and please take me off the call list.”

I doubt they had as much fun as I did on these calls.

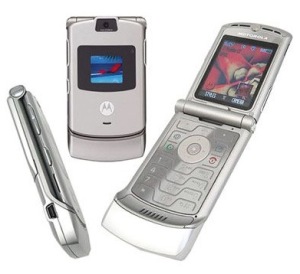

This pattern continued when I switched to the Razor phone. However, the only reason I switched was because my Sony phone caused more then a few accidental dialing episodes, and I was previously familiar with a flip phone. It was not, however, because the Razor phone was more “cool”, or anything else it was ‘supposed’ to be.

As I started independent consulting my global travel greatly reduced. Around that time the iPhone entered the market. I had hated the Blackberry, so thought I’d check it out. Everyone kept trying to sell me on an iPhone because “the camera was better”. Again, I didn’t care. What’s interesting was that every time I tried to ask about what was important to me, I was continually told about cameras, colors, texts, and all the other things I didn’t care about.

After considerable research (and by research I mean I had to translate from technophile speak into use cases and features that may actually matter to me) I did get an iPhone. A few things happened. Because it was easy to email pictures, I did use the camera. However, it was not because it was a great camera. I used it because it helped me to quickly describe things to people. For me, it was yet another communication aid.

So what’s the moral of this story here? Companies segmented me based on observations of previous purchase behavior. Based on those observations, cell phone companies assumed that I loved gadgets and new features. Nothing could be farther from the truth.

What would the real insight have been? That I value seamless communication from wherever I am. That’s the insight that describes the motivation that drove all of my behavior in the mobile phone market. Every product, feature, and service plan I have selected (or used after the fact) has been in service of that motivation. However, in all these years, I have never (not even by the mighty Apple) been ‘sold to’ on the basis of what truly mattered to me. Would it have been all that difficult to uncover this motivation at any point along my journey? I don’t think so. Are there other people out there who share my motivation? Most likely, yes.

Think about it – how could the market have been different if segmentation happened based on deriving insights about what truly mattered to people, rather than observations of what they bought or said they wanted? Would I have been lumped into the same group as the technophile? Probably not. Are there other categories with growth potential that are being missed? Most likely, yes.

And that’s what I mean by using insights vs observations as the basis from which to introduce new products, services, and business models to the market.