In my opinion, the book Capitalism Without Capital by Jonathan Haskel and Stian Westlake is one of the most important business books to have been written in the last five years. I felt the need to write a review because most people I run into in the course of day-to-day business haven’t read it. On the one hand, this surprises me, as it offers important guidance for businesses pressured to radically change the way they work due to the disruptive forces we are experiencing. On the other hand, I’m not surprised, since the book is a bit of a dry, tough read. (It was written by academic economists after all.) I’ve been a geek about the value of intangible assets since business school, and I would have likely abandoned it part way if it weren’t for the fact that it provided some of the best articulations of the value intangible assets I’ve ever seen.

I’m a geek about intangible assets because my business creates new intangible assets as the key to uncovering new opportunities. When asked “What does your business do for companies? Is it like market research? Or technology forecasting?” it’s often difficult to describe to someone who hasn’t experienced it – sort of like trying to describe swimming to someone who has never experienced water. The authors define intangible assets as things like ideas, knowledge, aesthetic content, software, brands, networks, and relationships. We’re all familiar with these things, but if asked to define how exactly they work, most of us would be at a loss.

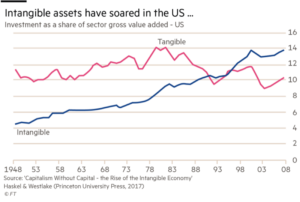

The authors not only do an excellent job of describing these assets, they point out how dramatically our economy has been shifting in terms of investment in, value created by, and under-reporting of intangible assets.

The authors define intangible assets as exhibiting four main characteristics: Scale (they can be used over and over again without being depleted), Sunkenness (if an investment fails, it is difficult to recover any value from the asset – ie: while you could sell outdated equipment, there is not much of a market for a logo for a failed business), Spillovers (others can benefit from the creation of the asset – think about new product categories that create market opportunities for others), and Synergies (secondary markets that actually enhance the value of the innovator). There are other reviews that define these characteristics in a more detailed way, but to me the main value of the book is the insightful guidance it provides for business leaders and policy makers who take the time to pay attention to it.

We are already seeing the impact of the intangible assets that exist today. Platform businesses like AirBnB, Facebook, Amazon, and all the rest have been exponentially changing the way business is done. This has created positive impacts like less friction and more choice in the market, and the democratization of luxury goods and experiences. But it has also created negative impacts such as increased income inequality, social disparity, and the proliferation of inaccurate and harmful information. The authors make good suggestions about policies that will need to be adopted to ensure that the positives will outweigh the negatives. But I worry whether we will have the political courage to take the necessary actions.

However, I am optimistic. I hear growing recognition of the value of “soft” skills to prepare us for the Future of Work. While some may wonder what that means, Haskel and Westlake have provided a whole book of ideas for how these skills will need to be used. For me, the possibilities are endless. The insights my teams develop are now being used not just for single product or technology pipelines, but to provide focus for companies seeking to compete in ever more interconnected ecosystems. It makes it more important than ever to focus on figuring out the right path forward, and not expecting to figure it out while in the market.